Payments can make or break your business. Especially in industries like forex and iGaming, where high volumes, international users, and regulatory complexity come with the territory.

Whether you're running a trading platform, sportsbook, or online casino, chances are you've hit a few of these common payment roadblocks.

The good news? They’re fixable—with the right setup.

At PAYOK, we work with dozens of high-risk platforms across Asia, LATAM, and beyond. Here are the 10 most common payment challenges we see—and how to solve them.

1. High Decline Rates on Card Payments

Let’s face it—cards are unreliable in this space. Between fraud filters, bank blocks, and cross-border issues, success rates are often painfully low.

What works better?

Local payment methods. UPI in India, Pix in Brazil, or wallets like OVO in Indonesia. When you offer what users are used to, you see higher approval rates and fewer headaches.

2. Payout Delays That Frustrate Users

Nobody wants to wait 3–5 days to get paid out. If your withdrawals feel slow or inconsistent, you risk losing your most active users.

The fix?

Automated, real-time payouts through local bank rails. With PAYOK, withdrawals can be processed in minutes, not days—keeping users happy and reducing support tickets.

3. Not Enough Local Payment Options

If your platform only offers cards and one e-wallet, you’re leaving money on the table. In many regions, users prefer their local bank apps, instant transfers, or even QR code payments.

Solution:

Go local. PAYOK supports 100+ payment channels—so you can meet users where they are.

4. Currency Conversion Losses

Cross-border fees and bad FX rates add up. Not just for you, but for your users too. That creates friction—and sometimes, abandonment.

How to fix it:

Use multi-currency wallets and real-time FX tools. This gives your users more control, and you more flexibility with how you price and settle transactions.

5. Fraud and Chargebacks

Unfortunately, high-risk industries attract fraud. Whether it’s stolen cards or friendly chargebacks, these issues can drain both revenue and resources.

What helps:

A solid fraud prevention setup. PAYOK combines KYC layers, risk scoring, and geo-controls so you can filter out bad traffic before it becomes a problem.

6. Regulatory Restrictions

It’s no secret that forex and iGaming face a more complicated regulatory landscape than most. Some banks won’t even touch you.

What you need:

A payment partner that understands the space. PAYOK is built specifically for high-risk verticals. We help you stay compliant, without slowing you down.

7. No Real-Time Payment Visibility

When your payments team can’t see what’s happening in real time, it’s hard to spot issues—or give users accurate updates.

The fix:

Live dashboards and automated reporting. With full visibility, your team can operate more efficiently, and your users feel more in control.

8. Mobile Experience Isn’t Optimized

Most of your users are depositing from mobile—but if your payment flow isn’t smooth, they’ll

drop off.

What works:

Mobile-first interfaces. At PAYOK, all checkout pages are designed for fast, secure mobile payments. One-tap wallets, biometric approvals, QR code support—we cover it all.

9. Onboarding Takes Too Long

If your payment provider is taking weeks to get you live, it’s already costing you.

How PAYOK does it differently:

We streamline onboarding with fast KYC, ready-to-go APIs, and a sandbox environment. You can go live in days—not months.

10. Failed Payments Hurt Your Reputation

Every failed deposit or delayed payout damages user trust. And in this industry, that’s hard to recover.

What’s better:

High-success-rate local methods, real-time routing, and reliable uptime. These aren’t just technical improvements—they protect your brand.

How PayOK Helps You Do It Better

We built PayOK for businesses just like yours—fast-moving platforms in regulated, high-risk industries that need reliable, local, and scalable payment solutions.

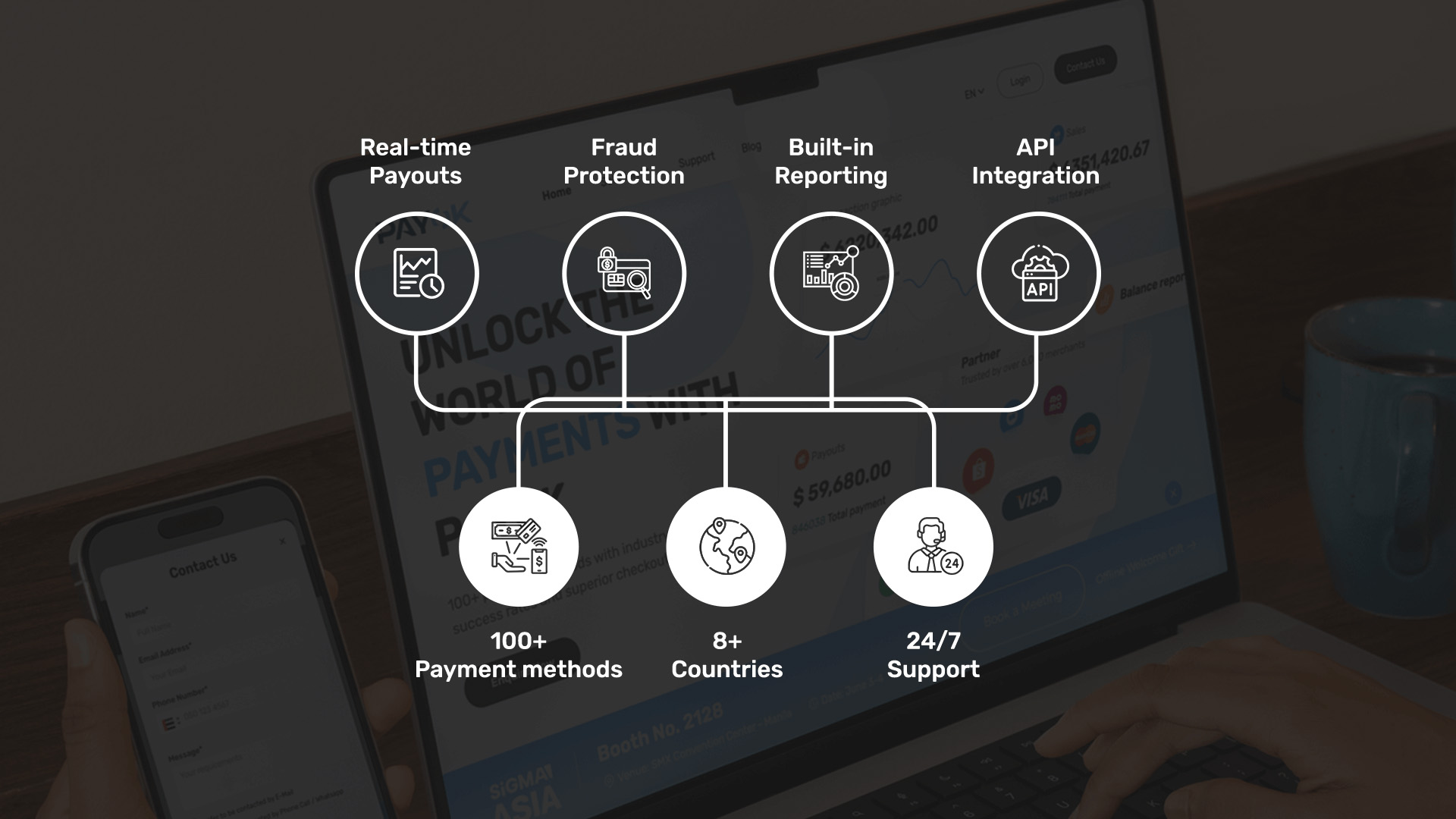

Here’s what you get with us:

- - 100+ local methods across 8+ countries

- - Real-time payouts and settlements

- - Advanced fraud protection and KYC tools

- - Simple API integration and onboarding

- - Full transparency, built-in reporting, and 24/7 support

Final Thoughts

Your payments shouldn’t be a pain point. They should be your competitive edge.

If you're tired of dealing with slow payouts, blocked cards, and support tickets about failed deposits—maybe it’s time to rethink your setup.

Let’s talk.

Reach out to PayOK and see how we can help you grow with smarter, more localized payment solutions.